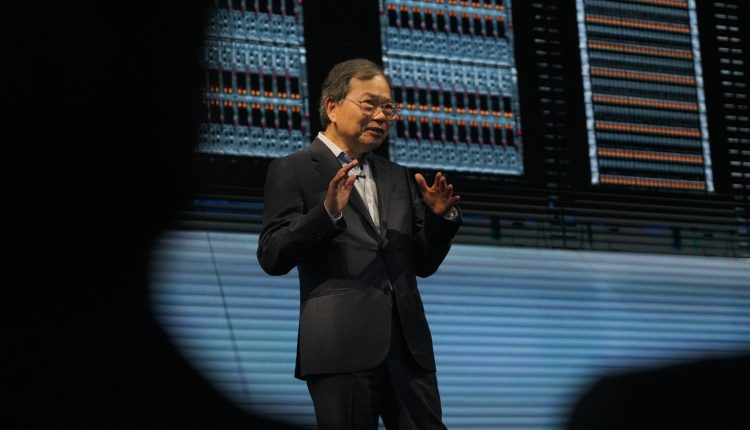

Charles Liang, CEO of Super Micro, speaks on June 1, 2023 at the Computenex conference in Taipei, Taiwan.

Walid Berrazeg | SOPA images | Light rocket | Getty pictures

Super Micro computer The shares decreased by 15% on Tuesday after the server manufacturer reported disappointing results of the fourth quarter and issued weak quarterly yield guidelines and issued a weak guidelines.

So the company has compared to the LSEG consensus:

- Win each share: 41 cents adapted compared to 44 cents

- Revenue: 5.76 billion US dollars expected compared to 5.89 billion US dollars

Super Micro's turnover rose by 7.5%in the quarter, which, according to an explanation, ended on June 30th. The net profit of $ 195.2 million or 31 cents per share was due to a decline of $ 297.2 million or 46 cents per share in the same quarter in the same quarter in the same quarter

“Although we took measures to reduce the effects, we will see the results,” said CEO Charles Liang in a conference call with analysts.

For the current quarter, Super Micro demanded 40 cents up to 52 cents in an adjusted profit per share for $ 6 billion to 7 billion US dollars in the first quarter. Analysts interviewed by LSEG searched for 59 cents per share and sales of 6.6 billion US dollars.

For the 2026 financial year, Super Micro generates sales of at least 33 billion US dollars over the LSEG consensus of $ 29.94 billion.

Super Micro recorded the increase in the rise in 2023 for its data center server, which with the MIT Nvidia Chips for dealing with artificial intelligence models and workloads. Growth has slowed down since then.

The company avoided being lived out of the Nasdaq after he had fallen back in quarterly financial submissions and had seen the departure of his auditor.

By the end of Tuesday, the Super Micro shares rose by 88% in 2025, while the S&P 500 index increased by 7%.

Do not miss these findings from CNBC Pro

Comments are closed.